Norris Lozano, Senior Attorney at Dayes Tax Relief, discussed tax relief and effective strategies to tackle unpaid taxes on local Arizona TV outlets ABC15 and CW7 in late April and early May. Lozano had the opportunity to share with viewers that there are ways to address tax resolution concerns, especially if you have the assistance of an experienced tax attorney on your side.

Senior Attorney Lozano on ABC15

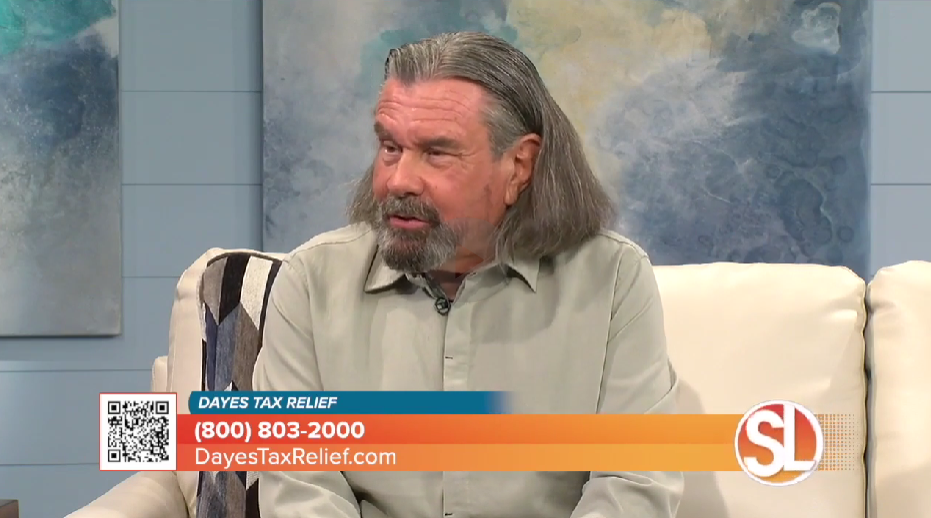

Lozano appeared on Sonoran Living on ABC15 on Tuesday, April 30, and discussed with Heidi Goitia what to do if you owe back taxes or have unfiled taxes.

“A tax attorney is a specialist in tax law,” he explained. He noted that they’re the person you want to call if you have a problem with the IRS, or even if you just think you may have an issue with the federal agency that needs to be addressed.

When asked about people who might be afraid of addressing tax issues because they haven’t filed taxes or have concerns about being audited, Lozano noted, “They should file their taxes. But they can come to us and we can file their taxes and deal with the IRS from that perspective.”

Lozano also explained the process if someone comes to Dayes Tax Relief for help, from an initial investigation to what can be done to remedy the situation like setting up a payment plan to resolve back taxes.

The Senior Attorney noted that the IRS is “not out there to take you down. They’re out there to get their money,” and how tax attorneys like himself work with the agency to resolve tax issues.

Ultimately, the most important thing is to get tax debt settled, and the tax attorneys at Dayes Tax Relief can help.

“We’re there to protect you,” Lozano said.

Lozano Appears on CW7

Lozano also made an appearance on CW7 on May 1 to further discuss tax resolution and compliance with Lexy Romano.

The two talked about how Lozano and Dayes Tax Relief work with people who owe taxes but may be too scared to tackle the challenge of getting them settled on their own.

“If you owe taxes, if you haven’t filed for it, if you owe back taxes, if you have tax returns that you need to file from a long time ago, or if the IRS is sending you letters…all those things we can help with,” Lozano explained. “We can take your fears away.”

Lozano also clarified the difference between a tax attorney and a CPA – notably, that discussions with tax attorneys are privileged.

“They can talk to an attorney and that’s a private conversation,” he revealed of taxpayers who may come to him for help. “And the IRS can’t make the attorney talk about it.”

The Senior Attorney also discussed how there’s “nothing that can’t be resolved,” and that Dayes Tax Relief can help guide people who come to them for assistance.

“The IRS is trying just to collect money and not spend too much time trying to collect it from the people they can’t,” he said.

“Some people I talk to are scared that [the IRS] are gonna come and arrest them. The IRS isn’t gonna arrest people. I mean occasionally they will, but rarely,” Lozano joked.

He noted that people who need help should give Dayes Tax Relief a call to get started.

“We’ll guide them through it, they don’t have to worry about a thing.”

To learn more about tax relief options available to you, please call the team at Dayes Tax Relief at (800) 803-2000 for a free, private consultation today.